Explore Origins Solutions

THE ORIGINS™ PLATFORM

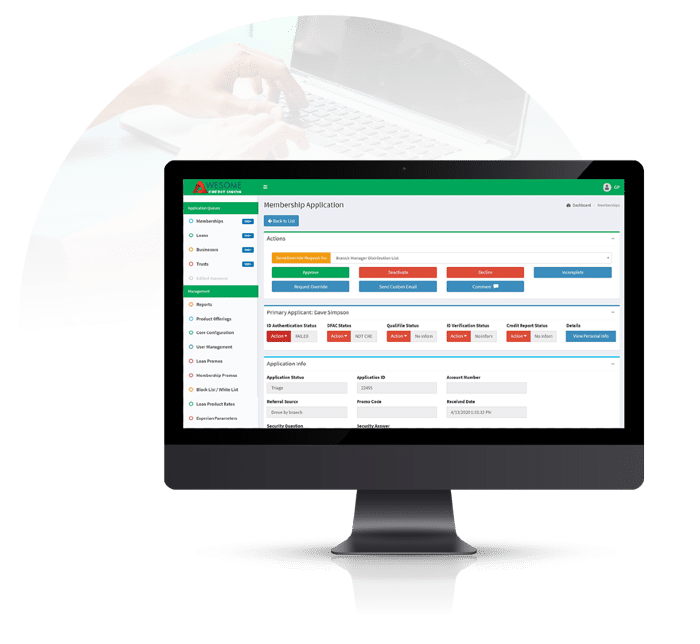

Whether in a branch or online, ORIGINS is the most comprehensive, fast, powerful, and flexible solution for growing your credit union. Designed by and built for credit unions, it uses modern, agile technology to optimize your existing back-office processes and assure healthy, future-proof growth.

ORIGINS powered by eCU Technology provides a comprehensive suite of modules to help your organization grow and thrive, delivering a personalized online user-experience.

MEMBERSHIP

ORIGINS takes advantage of modern technology and a simple interface to streamline the account opening process, so your members can sign up in less than half the time.

LOANS

Don’t lose loan applicants because the process is complex or takes too long. Our simple, quick platform makes applying easy, whether it’s an existing member or a new one just signing up.

MANAGEMENT

ORIGINS offers easy back-office management that supplements your current system. It integrates smoothly into all your existing membership and loan processes.

On average eCU Technology client institutions have experienced

auto approval rates up to 80%.

MEMBERSHIP MODULE

Modern, simple technology to open new accounts anytime, anywhere

This optimized, multi-channel platform makes it simple and stress-free for prospective members and staff alike to complete an application, whether it’s in a branch, over the phone, or online.

KEY BENEFITS

- Open new accounts in under 5 minutes

- Intuitive design and workflow make the application quick & easy

- ID photo capture and auto-fillable forms reduce data entry

- Provides real-time funding options including debit, credit, ACH & mobile check deposit

- Full digital document support for a variety of deposit accounts

- Integrated ID verification and credit checks streamline the approval process

- Automatic approval and core system account creation

LOANS MODULE

Quick loan application, with AI auto loan decisioning

A simple but thorough interface and robust third-party integration ensures that your new & existing members have easy loan application options and you have what you need to quickly and confidently make decisions.

KEY BENEFITS

- Responsive system makes the loan process simple and easy

- Designed mobile first with access on any device

- Integrates with core system to auto-populate existing member data

- Flexible architecture supports multiple products

- Straightforward operations interface for back-office review & loan processing

BACK-OFFICE MANAGEMENT MODULE

Manage the membership and loan process simply and easily

This secure, reliable, and easy to use platform integrates seamlessly with your existing processes, while automated approval options and back-office tracking give you the power to manage your membership and loan applications easily.

KEY BENEFITS

- Back-office platform allows staff to see high-level and detailed application data

- Target members and track marketing campaigns with promotional codes tied to application

- Easily document staff data on applications for internal reporting and audit purposes

- Data is always safe, secure, accurate, and backed up

- Web-based system is highly reliable and always available