Online Account Opening & Loan Origination Platform

Growth Starts Here.

The result for our clients is a simplified process with increased efficiency & productivity for your organization and an enhanced user-experience for your members.

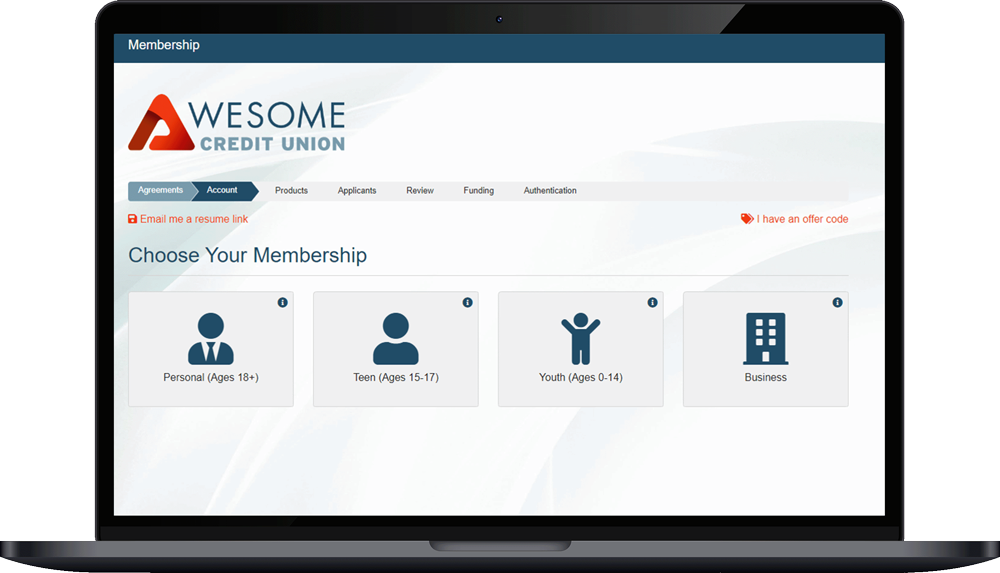

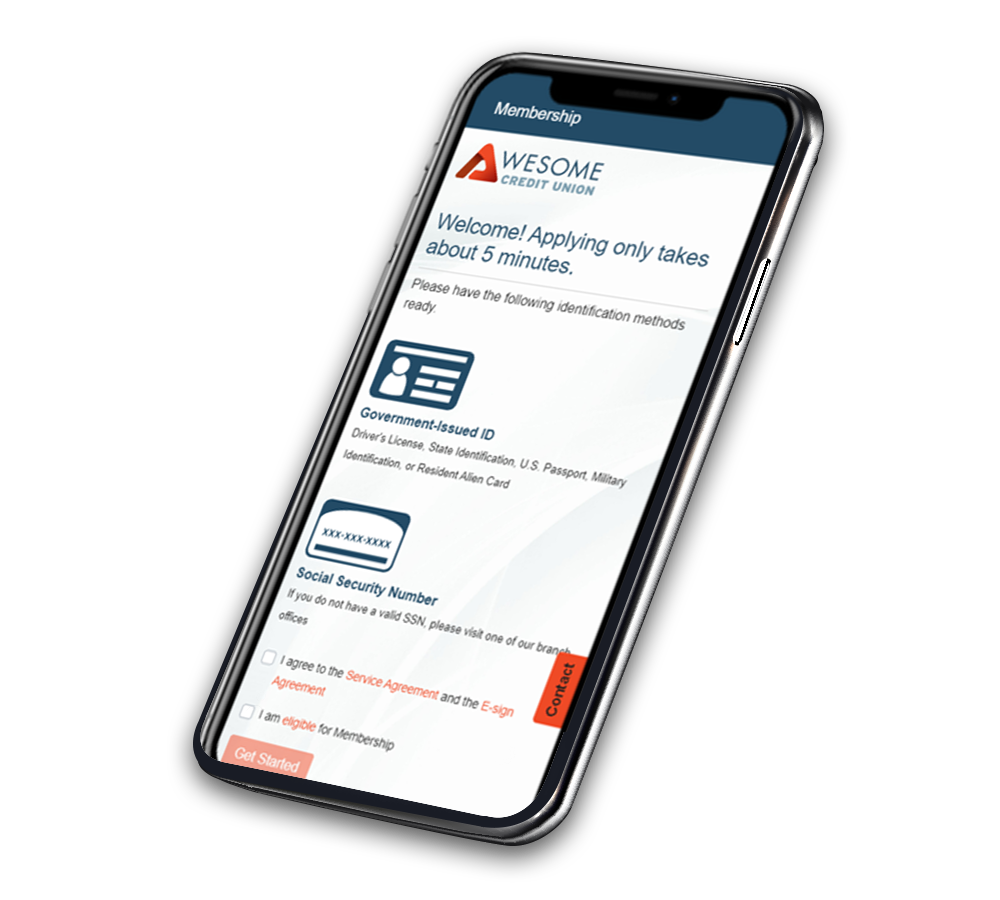

account opening

platform

for easy

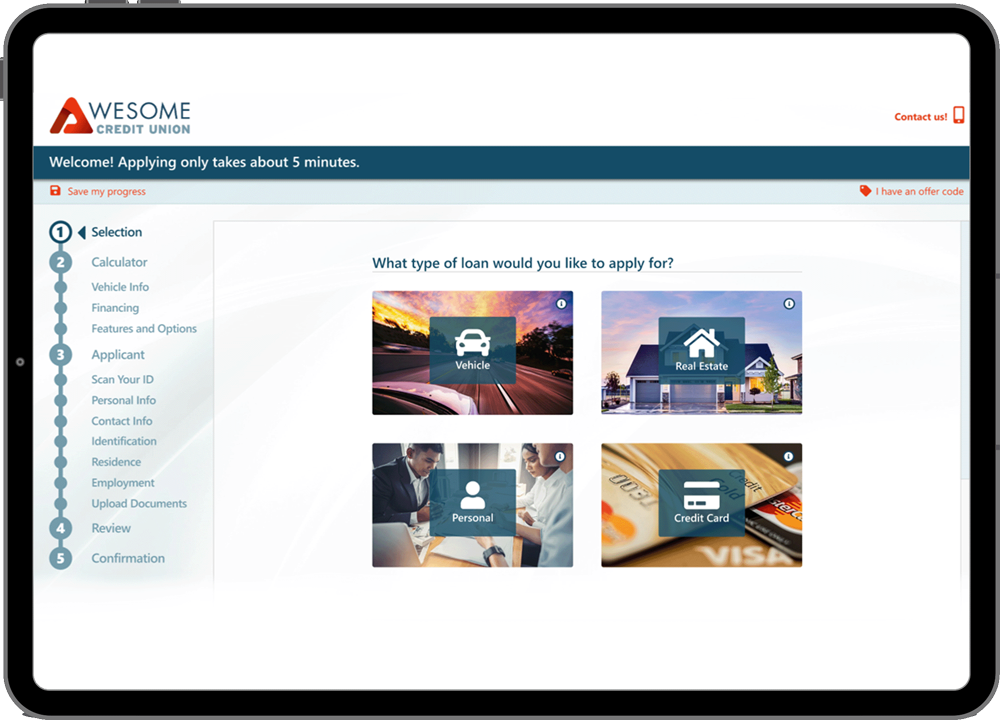

application

in-branch

business

account

origination

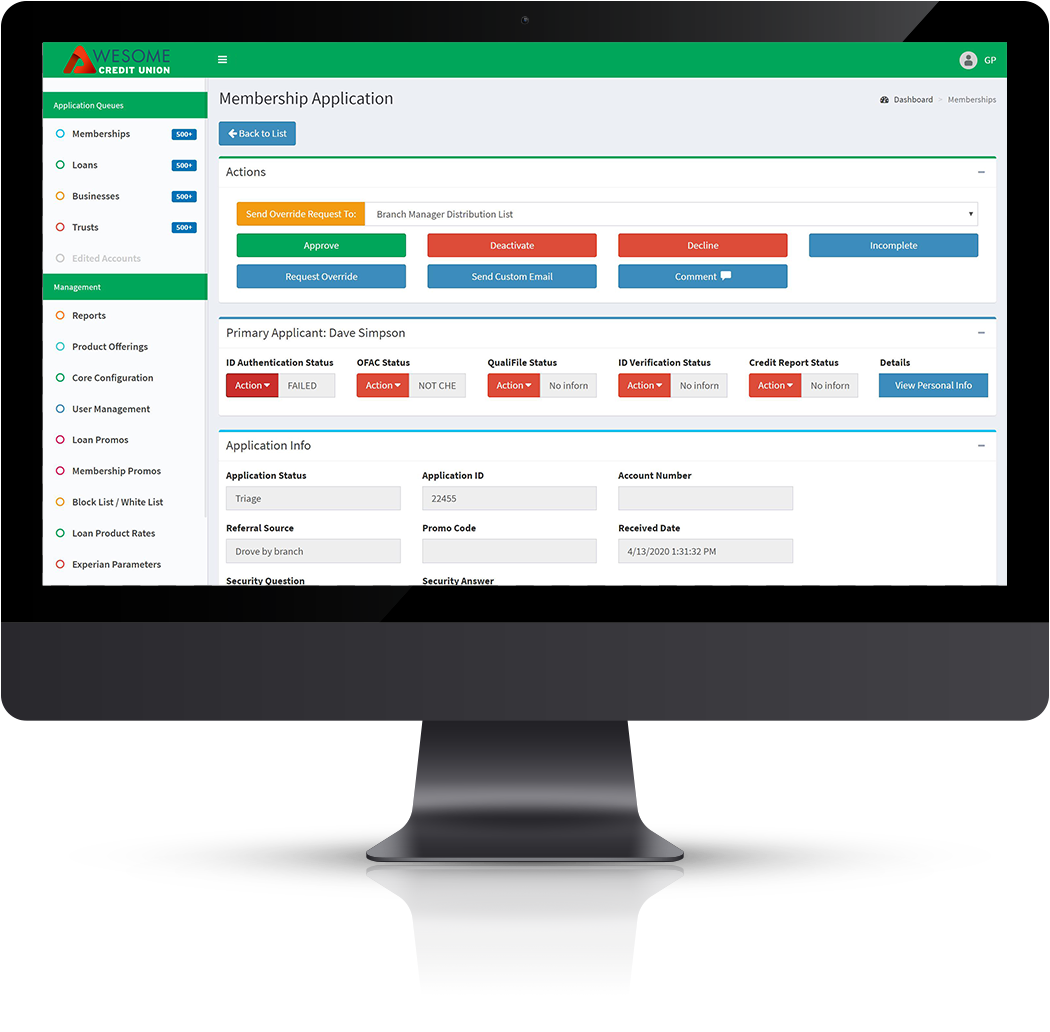

back-office use

WHY WORK WITH US?

AUTOMATED ACCOUNT OPENING & FUNDING

Consumers can easily apply within 3-5 minutes and access their account within the app.

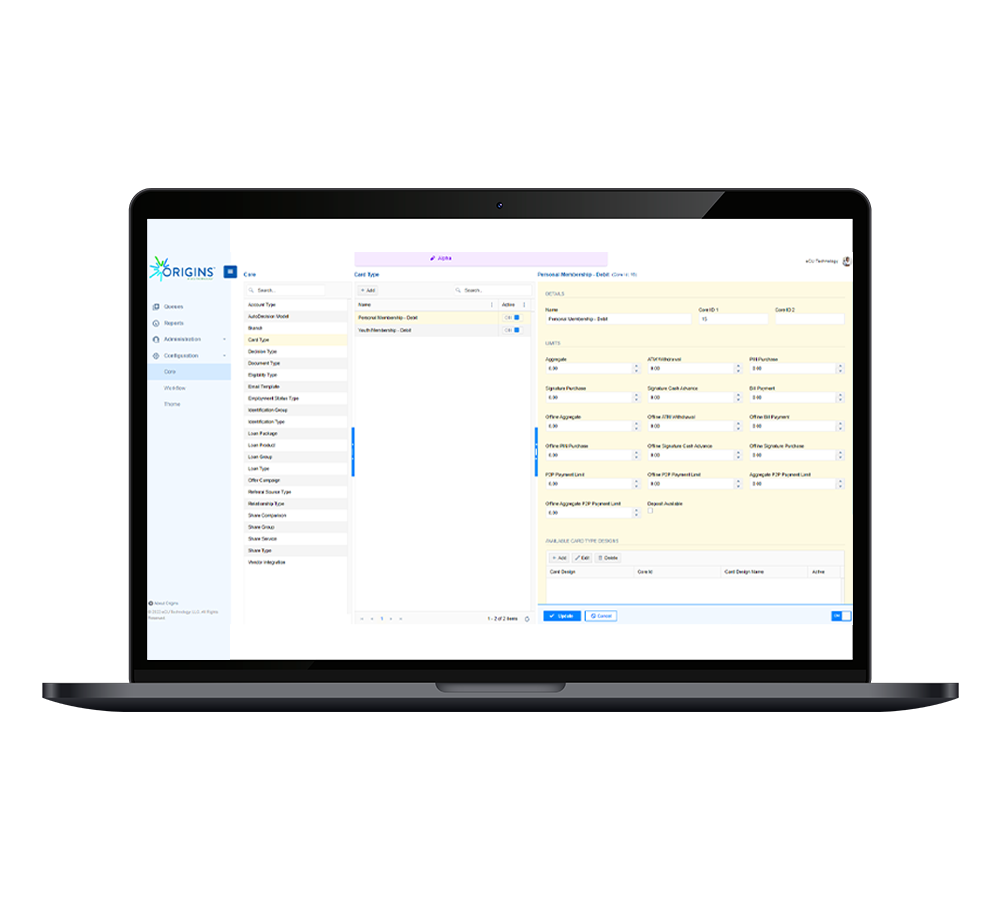

HIGHLY CONFIGURABLE FOR YOUR NEEDS

Create a branded & configurable solution unique to your credit union’s needs.

DESIGNED BY & BUILT FOR CREDIT UNIONS

We understand the needs and challenges credit unions face on a day to day basis.

COUNTLESS FEATURES

ORIGINS uses modern, agile technology to optimize your existing back-office processes and assure healthy, future-proof growth.

$0M+

$0M+

0+

0%

SEE ORIGINS IN ACTION

We’ve designed ORIGINS to enhance the overall user-experience for your credit union’s membership and your employees. Efficiently handle personal accounts, business accounts, membership/loan workflows, and back office management all within one comprehensive system.

Learn more about how the ORIGINS Platform can maximize the growth of your organization!